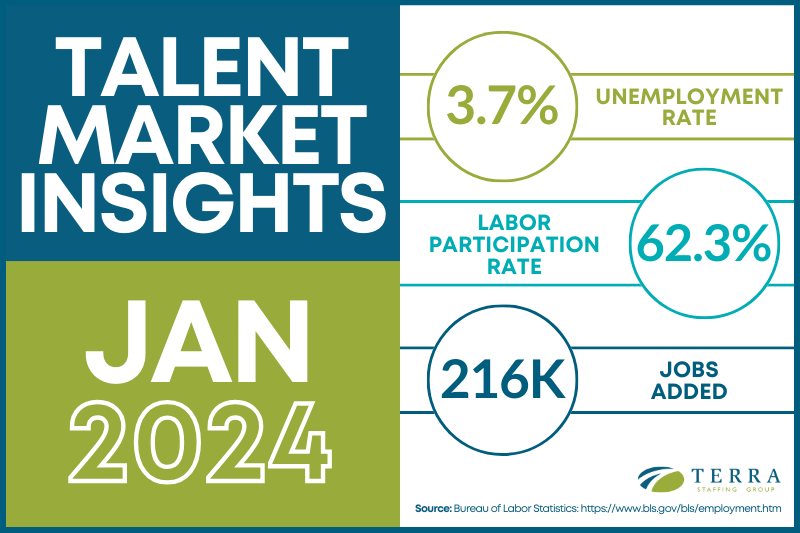

January 2024 Talent Market Insights

Posted on January 10, 2024

December marked a strong end to a robust year of job growth in the labor market.

And while last month’s jobs report showed higher than forecasted job gains, it has also gently slowed from the high job growth in 2021 and 2022.

After several interest rate hikes throughout the year, inflation lowered from 6.5% in December 2022 to 3.1%. And despite multiple rate hikes, people continued to spend throughout the year—including holiday spending, which hit a record in online sales in December.

In this post, we’ll delve deeper into what’s going on in the labor market, reflect on 2023, and what this means for employers in 2024.

Key takeaways:

- 216,000 jobs were added in December 2023, above the forecasted 170,000, marking the 36th consecutive month for job gains.

- There were 2.7 million jobs created in 2023, averaging 225,000 every month (and down from 4.8 million in 2022).

- The minimum wage increased in 22 states, effective January 1st.

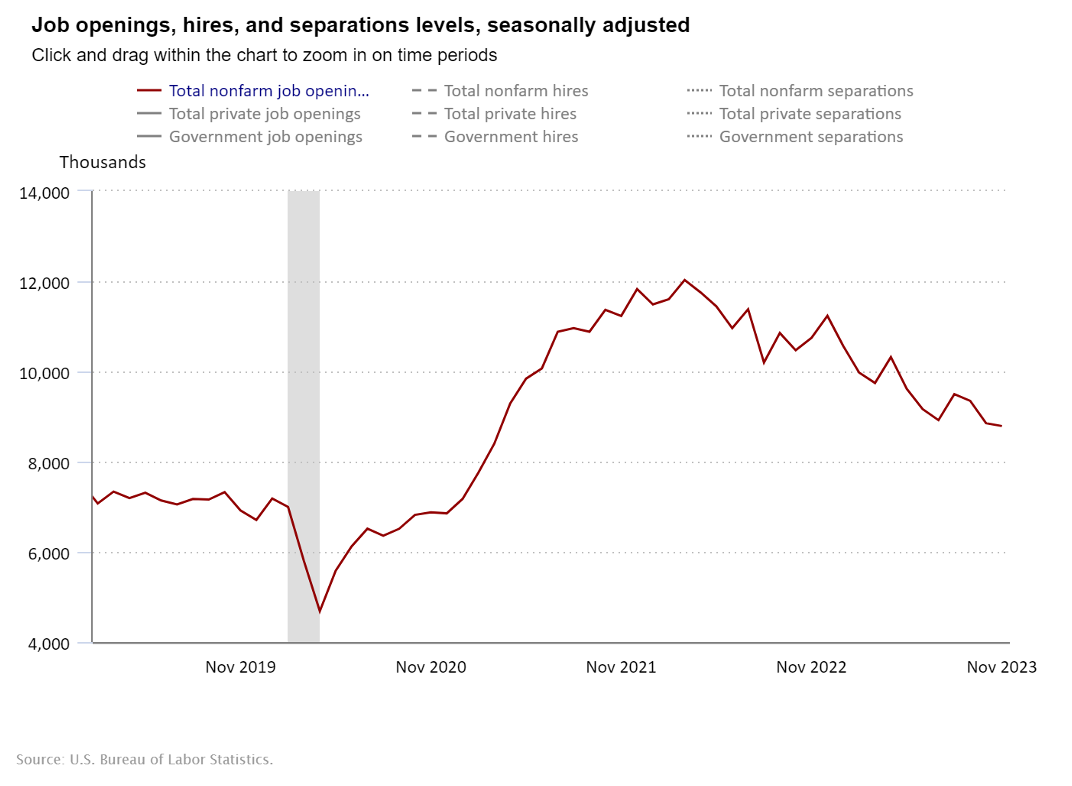

Number of Jobs Available

December’s jobs gains were larger than expected, reflecting a healthy, robust economy throughout 2023.

Industries leading in jobs added include government (+52,000), social assistance (+21,000), healthcare (+19,000), and construction (+17,000).

The latest Job Openings and Labor Turnover Summary (JOLTS) shows job openings in November changed little, from 8.7 million in October to 8.8 million in November.

Job gains for October and November, however, were revised down. October’s job gains totaled 105,000 (below reported 150,000) and November’s gains totaled 173,000 (below reported 199,000).

Overall, 2023’s job market cooled significantly while consumer spending remained strong, and some are already referring to the “soft landing” the Feds were hoping for as a mission accomplished.

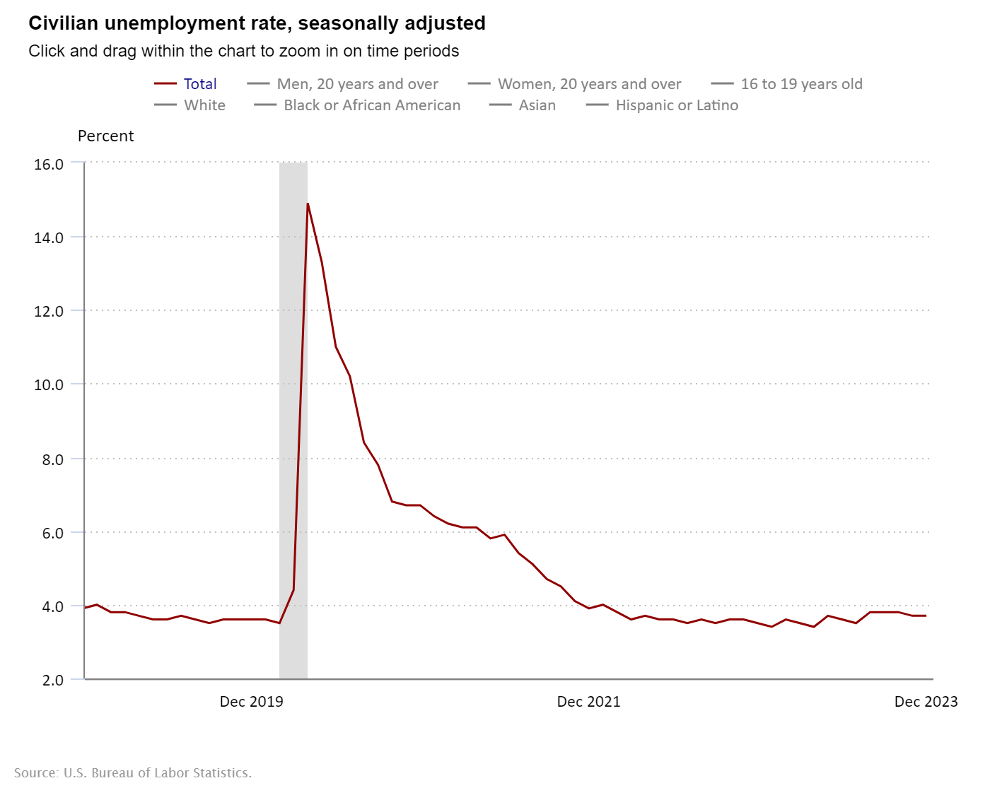

Unemployment

Unemployment remained unchanged at 3.7%

Among Black or African American workers, unemployment dropped from 5.8% in November to 5.2% in December. And the unemployment rate among Hispanic or Latino workers rose from 4.6% in November to 5% in December.

Mass layoffs continued in December, from major retailers such as Etsy and Zulily, despite an uptick in e-commerce spending compared to last year. According to this Tech Layoffs tracker, 1184 tech companies laid off 262,242 workers in 2023.

Employment in transportation and warehousing declined by 23,000 in December. Since reaching a peak in October 2022, employment in transportation and warehousing has decreased by 100,000, according to the Bureau of Labor Statistics.

While the unemployment rate has zig-zagged somewhat throughout the year, the unemployment rate is in line with pre-pandemic levels, returning the economy back to “normal.”

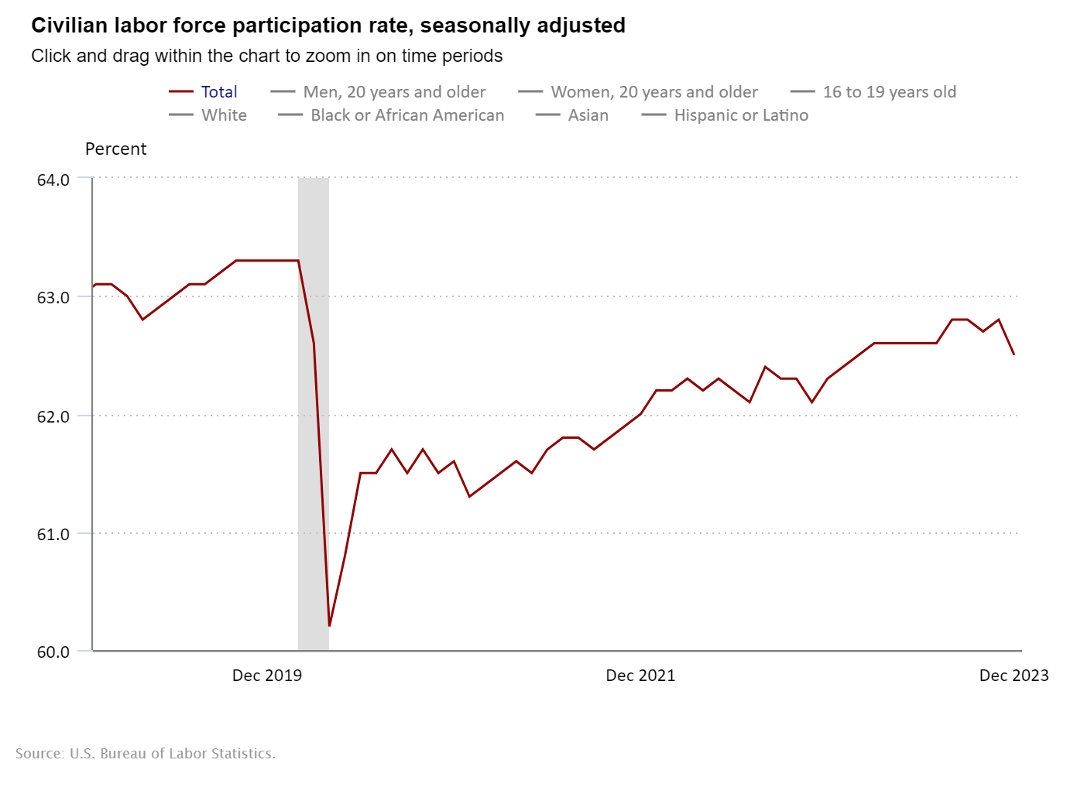

Workforce Participation

Workforce participation dropped from 62.8% to 62.3%, the lowest since February, which may concern Feds.

Having more people in the labor force eases pressure on employers to raise wages to attract or retain talent. When wages increase, so does the risk for inflation.

That said, the workforce participation rate changed little throughout the year and the total number of people employed surpassed pre-pandemic levels back in June 2022, and has continued to increase.

There is also some concern over the drop in the employment-population ratio among prime-age workers, which measures the number of workers currently employed against the total working-age population of a region.

Though this percentage fell to 80.4% and is being reported as “the lowest since January,” it is still in line with pre-pandemic levels.

Overall throughout 2023, workforce participation has remained strong.

Wage Growth

In December, average hourly earnings increased by 0.4%, the same as November 2023.

And effective January 1st of this year, 22 states and over three dozen cities increased their minimum wages. Nearly 10 million workers have received a pay bump.

Tukwila, Washington, about 10 miles south of Seattle now has the highest minimum wage in the country for large employers, at $20.29/hr.

Key Variables for Employers to Keep an Eye on in 2024

In the ever-evolving job market landscape, certain variables demand close attention. Here are some key factors that will shape the employment landscape in 2024:

- Consumer Spending. While people continued spending in December, the aftermath of holiday splurges may impact January spending.

- Inflation (and Federal Reserve Decisions). While Feds hinted at potential rate cuts in 2024, that decision depends on economic conditions and December’s hot jobs report could change their mind. The next Federal Open Market Committee (FOMC) meeting will take place January 30-31st.

- Wage Growth and Minimum Wage Increases. Minimum wage increases and overall wage growth could potentially influence the Federal Reserve’s decision to keep interest rates up to counterbalance inflation.

- Workforce Dynamics: The age demographic of the workforce is shifting, which may possibly impact labor availability. As the population ages, finding skilled workers will become more challenging, as older workers may be less likely to seek employment.

2024 Winning Moves for Employers

As we step into 2024, the employment landscape is undergoing a shift from the tumultuous “Great Resignation” to the more strategic “Big Stay.” To remain competitive in this evolving environment, employers need to adapt and implement winning strategies.

Here are some effective strategies to maintain a competitive edge:

- Prioritize Employee Retention. Create a workplace that attracts and retains talent. Prioritize inclusivity, offer growth opportunities, and implement Diversity, Equity, and Inclusion (DEI) initiatives. Addressing employee well-being fosters a sense of value and loyalty.

- Leverage January Job Search Trends. Take advantage of increased job-search activity at the beginning of the year. Consider targeted recruiting campaigns to attract top talent during this opportune time, when people are more likely to search for a new job.

- Stay Competitive in Compensation. Stay informed of compensation trends to remain attractive to talent. Find a balance between competitive pay and strategic compensation approaches that align with your business goals.

- Explore Temporary Staffing Solutions. Embrace the flexibility of temporary staffing as a cost-effective solution. This approach allows businesses to address fluctuations in staffing needs, meet project deadlines, and maintain productivity goals regardless of market conditions.

- Clearly Convey Job Security. Address concerns related to economic instability by providing transparent communication about your company’s stability. Demonstrate a commitment to employee well-being during challenging economic periods, fostering a sense of security.

If you’re looking for more resources, be sure to check out our employer resource center. We have an archive of on-demand HR webinars, tools and articles to help you navigate various workplace challenges.

Feel free to reach out to us for insights into market trends and assistance with your staffing decisions.

Categories: Staffing Tips & Recruiting Trends

Tags: job market data, labor market trends, Talent Market Insights, Talent Market Insights January 2024